The plant-based food industry has seen significant growth and transformation over the past five years. Despite speculation of a slowdown, the latest report from the Plant Based Foods Association (PBFA) indicates otherwise.

One survey in PBFA’s report shows that nearly 40 percent of Kroger shoppers increased their spending on plant-based foods in 2023, indicating that the market continues to evolve and expand to meet consumer needs.

“After years of product innovation and adapting to consumer interests, values, and taste preferences, the plant-based foods industry has demonstrated its unique ability to iterate and grow,” Linette Kwon, PBFA’s Data and Consumer Insights Analyst, tells VegNews.

“[This is] all in step with the understanding that food is more than just a product on a shelf, but an opportunity to build connection, and feed the curiosity and desire at the core of purchasing decisions,” she says.

Why people keep buying plant-based food

Who’s buying all this plant-based food? PBFA’s report shows that this consumer segment is quite diverse.

According to the consumer survey—conducted in collaboration with grocery giant Kroger and market research firm 84.51°—the reasons behind the increase in plant-based food purchases are diverse. Health remains a primary motivator, with 51 percent of Kroger shoppers citing health benefits as the main reason for choosing plant-based foods.

However, other factors such as taste, flavor preferences, and the desire for variety are also playing crucial roles. More than one-third of shoppers reported that they like the taste and flavor of plant-based foods.

Impossible Foods

While health is a top motivator, taste, and sustainability concerns are also significant. The report found that 38 percent of Kroger shoppers purchase plant-based foods to reduce their animal-based food consumption due to personal health concerns. Additionally, 33 percent of shoppers increased their spending because they believe plant-based foods are better for the environment.

“PBFA’s 2023 consumer survey found that more than one-third of shoppers like the taste and flavor of plant-based foods, while nearly 40 percent indicated that they increased their spend on plant- based foods due to the greater variety of products now available,” Kwon says.

Plant-based food is flying off (digital) shelves

In the last five years, the retail landscape for plant-based foods has changed dramatically. From 2018 to 2023, the plant-based foods industry grew by 79 percent in retail dollar sales. In 2023 alone, US retail sales for plant-based foods held steady at $8.1 billion despite economic challenges.

Eat Just

Eat Just

Notably, plant-based creamers, ready-to-drink beverages, protein liquids and powders, baked goods, and eggs all saw growth in both dollar and unit sales.

E-commerce, where competition for physical shelf space is not an issue, has also become a significant channel for plant-based foods. In 2023, e-commerce sales reached $394 million, with a three-year compound annual growth rate of 16.4 percent from 2020 to 2023.

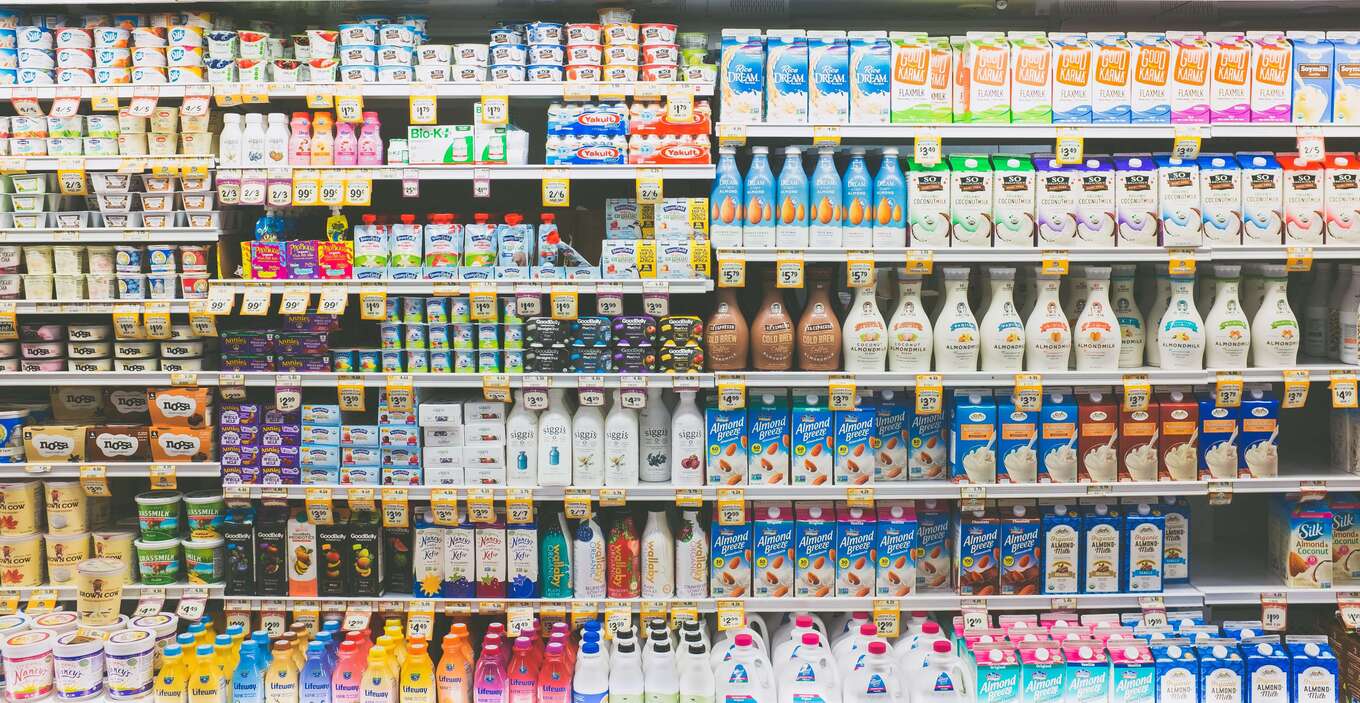

Plant-based foods occupy a larger share of online sales compared to brick-and-mortar stores, with 6.8 percent total share online versus 3.8 percent in grocery retail. This suggests that the variety of plant-based foods available online without the limitation of physical shelf space is meeting consumer needs more effectively.

Silk

Silk

In its report, PBFA also looked at how plant-based foods are performing at convenience stores and found that plant-based yogurts saw a 277-percent spike in dollar sales last year.

“Although plant-based food dollars are relatively small in convenience stores, our 2023 sales data demonstrates that c-store shoppers are engaging more and more with plant-based foods, which presents an opportunity to continue providing more easily accessible, convenient, on-the-go plant-based options,” Kwon says.

Plant-based vs animal-derived

In 2023, plant-based foods outperformed their animal-based counterparts in several key categories.

Unsplash

Unsplash

For instance, retail dollar sales of plant-based milk reached $2.9 billion, while dollar sales of animal-based milk declined by $280 million, or 1.6 percent. Additionally, while the repeat purchase rate for tofu, tempeh, and seitan grew by 0.7 percent over the last year, the repeat rate for packaged animal-based meat declined by 0.2 percent.

This suggests that shoppers are increasing their engagement with tofu, tempeh, and seitan while decreasing their engagement with packaged animal-based meat.

“We also continue to see a rise in the number of consumers saying that they actually prefer the taste of plant-based foods over their animal-based counterparts,” Kwon says.

Other plant-based categories have shown remarkable growth in recent years. Retail dollar sales for plant-based meat reached $1.24 billion in 2023, with 15.1 percent of households purchasing and 61.5 percent repeating their purchase.

Other categories such as plant-based yogurt, butter, cheese, and ice cream have also seen steady sales, with plant-based creamer growing by 10.4 percent to reach $701 million.

Califia Farms

Califia Farms

Additionally, plant-based eggs reached $43 million in sales, with a notable increase in repeat purchases. Plant-based protein powders and liquids also saw significant growth, reaching $392 million, up 8.1 percent from the previous year.

The future of plant-based foods

Looking ahead, the plant-based foods market is poised for continued growth, in both the retail and foodservice sector. Increasing consumer awareness of sustainability and health benefits, coupled with the excitement of new product varieties, will drive demand.

Large foodservice organizations such as Sodexo and Ahold are setting plant-based food targets to achieve their climate goals, indicating a broader acceptance and institutional support for plant-based options.

“There are tons of new innovations in this space and it’s constantly evolving,” Rob Morasco, Vice President of Innovation at Sodexo, said in a statement. “The need to find a solution to our environmental challenges is only going to increase.”

The foodservice sector has seen a significant rise in plant-based options, with operators responding to the growing demand from consumers. According to the PBFA report, foodservice operators increased their investment in plant-based foods in segments such as workplace cafeterias, education, healthcare, and government institutions.

From 2022 to 2023, the dollar investment in tofu grew by 17.5 percent, and investment in plant-based milk grew by 20.9 percent, outpacing the change in dollar investment in dairy milk. This trend indicates a strong potential for plant-based foods in non-commercial spaces.

“We do think, however, that the products that emulate the big ‘ordinary’ protein movers—beef, chicken, pork, and seafood—are the most important to the non-commercial space,” Morasco said.

“We sell a lot of hamburgers and chicken tenders and need plant-based alternatives to those that taste like the ordinary version,” he said.

Despite interest from consumers and foodservice operators alike, the plant-based food industry faces a unique challenge.

“Plant-based foods are still competing in an uneven marketplace due to the proliferation of low-cost, animal-based foods, the affordability of which is made possible by government subsidies,” Kwon says.

For more plant-based stories like this, read:

JUMP TO ... Latest News | Recipes | Guides | Health | Subscribe